5+ most popular commodities

Trade multiple commodities daily

24/7/365 customer support

What are CFD Commodities?

CFDS, or Contracts For Difference, are financial contracts that pay the difference between open and closing prices.

A CFD is a derivative product, which means you don't own the asset, so if you enter a CFD you won't need to store $100 of coffee beans somewhere. CFDs allow you to speculate on price movements without taking ownership of the product itself.

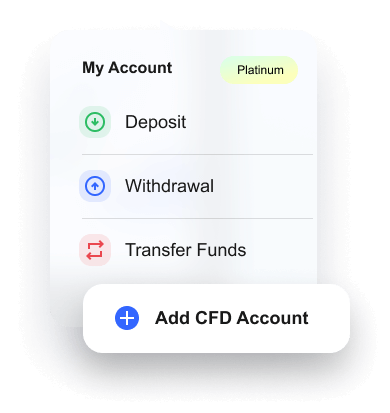

Investing in CFDs gives investors the opportunity to trade commodities over a short period of time. Among retail investors, this is one of the reasons they are popular.

The short-term nature of CFDs often results in huge leverage offers from brokers, with some offering leverage of up to 1:100. Therefore, if you trade with $100, you can leverage $10,000 in order to trade. Traders are able to dramatically increase profits by multiplying the reward by 100, but they also increase their risks by 100.

Instruments Traded

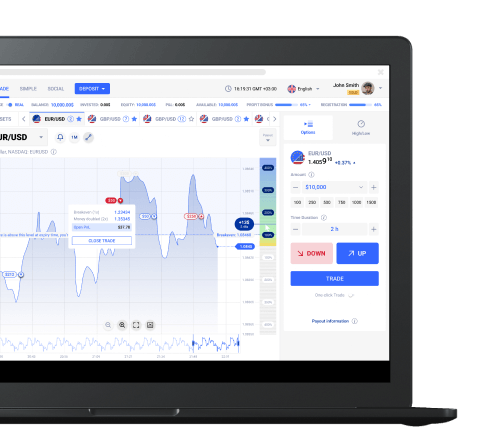

How to Trade Commodities with Option2Trade?

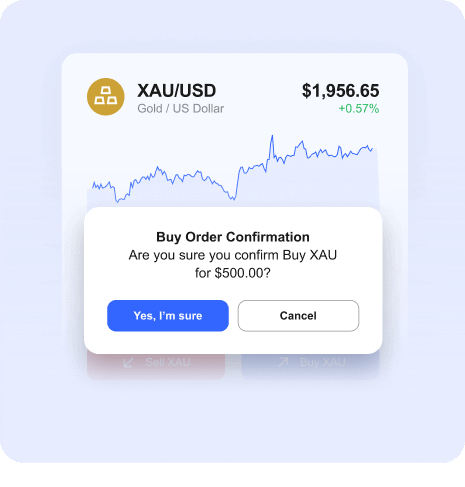

Simply trade the price movement of commodities by clicking ‘Buy’ if you predict the asset class will go up within a preselected period of time, or click ‘Sell’ if you predict the price will fall.

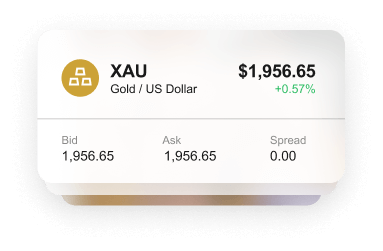

- The value of commodities are mostly driven by supply and demand. Many investors often put their money in commodity asset classes in times of uncertainty.

- Gold is extremely popular amongst traders and investors due to its demand and desire to hedge against inflation and currency devaluation.